Miller’s remains true to grandfather's standards

A company doesn’t stay in business 75 years by accident - it happens because of hard work, treating people right and giving back to the community. The William Albert Miller Insurance Agency at 220 E. Washington Avenue celebrated that milestone Thursday, March 24, as hosts for the Navasota Grimes County Chamber of Commerce After-Hours Mixer. The event was attended by clients, family and friends too numerous to count — and held special significance because it was also the 79th birthday of William “Bill” Albert Miller, Jr.

Navasota time capsule

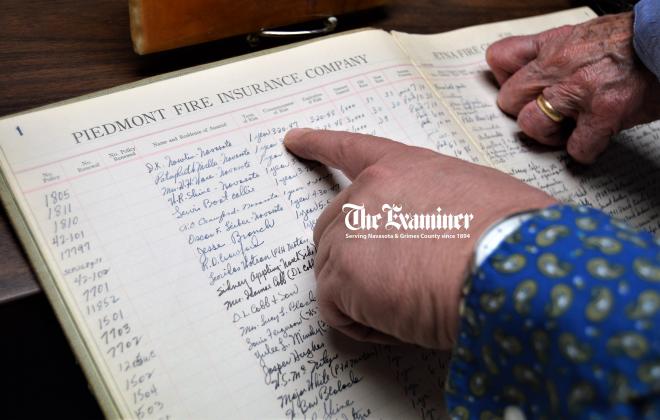

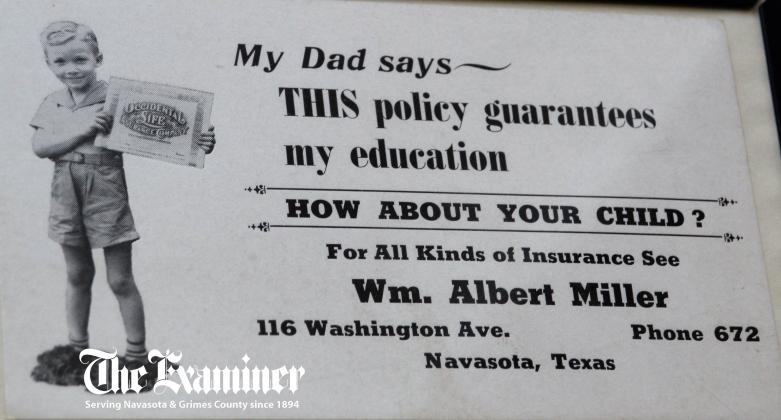

Miller about the agency’s beginning is like opening a time capsule. In Post-World War II America, an entrepreneurial spirit was as good as a degree and many a veteran became a financial success armed with nothing but determination and a dream. One of those veterans starting from scratch was William Albert Miller, Sr.

According to Bill, Miller dropped out of Blinn Junior College after the tragic loss of one of his two closest friends on the U.S.S. Arizona.

Bill said, “Daddy quit everything he was doing and enlisted. When he came back, he worked at various oil refineries and decided to try his hand at insurance. It was a lucrative field at the time. He walked around and sold policies. The first contract he had was with a company where you paid the premium by the week or month. He’d go and collect fifty-cents or a dollar every week.”

Miller’s first office was on the third floor of the bank building at the corner of Washington and Railroad Street, known to many old-timers as the Noto’s building, or to newcomers as the home of Rail & Rye. He moved several times before purchasing the building where presently located.

Forward thinking

According to Bill, his father had a knack for negotiation.

Grandson and Navasota Mayor, William Albert “Bert” Miller III said, “Grandfather was more into economic development than he was into insurance.”

With Navasota’s development potential in mind, Miller said his father collected donations from local business owners and purchased land south of Navasota for what is now known as the Navasota Industrial Park.

Another time, upon hearing about a Houston furniture company destroyed by fire, Miller immediately drove to Houston and persuaded the owner to relocate to Navasota.

During the 1960s, Miller served as chairman of the Brazos Valley Development Council, and in 1969, Governor Dolph Briscoe presented the Navasotan with the VIDY Award — “Volunteer Industrial Developer of the Year” for the State of Texas on behalf of the Texas Industrial Council.

“Claim” to fame

Bill joined his father at the agency in 1971, followed by Bert in 1997 after the senior Miller was injured in a tractor accident. One bit of relatively unknown trivia which Bill likes to call his “claim” to fame involves some excellent coverage advice he gave a “Navasota boy” who was an attorney living in River Oaks.

Bill said, “This young man was jogging one day, a storm blew up and he ran into Roy’s yard and got under his tree. The wind blew a limb off, and it fell on him. He’s 24-25 years old and he’s paralyzed. I paid the biggest claim this agency ever paid. I paid a $1,300,000 to this young man who broke his back. That young man is now the governor of Texas Gregg Abbott. I made him a rich man.”

Insurance then, now

Without a doubt, the insurance industry has changed in 75 years. In 1947, most people wanted to insure just their house and car. Now a business might have to contemplate the need for a terrorism policy.

Agent training requirements have changed as well. Instead of passing a state exam, continuing education is required for 25 years in addition to what is expected by the different carriers. Government regulation has increased and a lot of companies that were household names have merged or no longer exist. Changes in the law allowing lawyers to advertise has increased awards.

Miller’s staying power

Addressing the misconception people have about premiums, Bert said, “People may think that when they pay a $1,000 premium for a policy that we’re getting $1,000. We may get 10%. You’ve got to write a lot of volume to make payroll and hope to make a profit.”

Whatever needs the business might have, even if it’s cost-of-living raises for its employees, Bert said, “We can’t add on. It’s not ethical for us to add on. The State sets the premium and agrees on the rate. You have to write a lot of policies to make it in the industry.”

Miller’s Insurance is particular about the insurance they offer. According to Bert, they look at the brands by their financial rating, if they pay their claims and are “not always looking for a way out.” As independents, Miller’s is able to be competitive because they can shop around.

Bert credits the business’ longevity to “the staying power of the standards my grandfather set.”

He said, “We haven’t changed a whole lot. The way he ran the business worked and it served the community. We’re carrying on his legacy. He was very community involved.”

He added, “We try to get the best deal we can for our customers because we have to live where we do business.”